🌐 Digital Asset Bills, Natural Asset Companies & the Future of Data as an Asset

Around the world, new digital asset bills are being passed that finally give legal recognition to crypto-assets, tokenized rights, and—by extension—data structured as tradable assets. These laws are game-changers because they enable companies (and their accountants) to:

1. Reclassify Data from Liability to Asset

For decades, the data that companies hold has often been treated as a liability—with risks around privacy, security, and compliance dominating boardroom discussions. With digital asset laws, companies can begin to classify tokenized or self-custodied data as a balance-sheet asset. Just as intellectual property became a recognized intangible asset, data too can now be quantified, valued, and mobilised.

2. Create Incentives to Liberate Data for the Market

Once data is recognized as an asset, companies have a financial reason to unlock it rather than bury it. This creates momentum for new data marketplaces, interoperability frameworks, and secondary trading—enabling liquidity in what was once trapped, siloed information.

🌱 Parallels with Natural Asset Companies

A useful parallel comes from the rise of Natural Asset Companies (NACs). These are corporate structures, recognized on exchanges like the New York Stock Exchange, that enable ecosystems—forests, rivers, biodiversity reserves—to be accounted for and monetized as assets. Instead of treating nature as an externality, NACs put ecological value directly onto balance sheets.

Just as NACs transform natural capital into financial capital, digital asset frameworks allow companies to transform informational capital into financial capital. Both share a common logic:

Recognition: What was once invisible on balance sheets (ecosystem services or enterprise data) becomes a measurable asset.

Incentivization: Ownership and tradability create incentives for conservation (in the case of NACs) or data liberation (in the case of SeCuDAs).

New Markets: NACs give rise to carbon and biodiversity markets; digital asset bills open pathways to compliant “smart data schemes” and markets.

🚀 Why These Bills Are a Game‑Changer

From Liability to Asset

Digital asset bills—like the EU’s MiCA regulation, the US CLARITY Act, and frameworks in Singapore, Brazil, and Antigua—establish the legal scaffolding for companies to move data from compliance liability into a strategic financial asset.

Incentives to Liberate Data

By codifying data’s asset status, these bills drive companies to tokenize, custody, and license data into circulation. This is where SeCuDAs (Self-Custody Data Assets) become critical: they provide the programmable, standardized, yield-bearing structure for data to flow into markets responsibly.l with frameworks for asset transmission.

🙌 Citizen Empowerment & Institutional Innovation

Reclassifying data as an asset does more than unlock corporate value—it reshapes the relationship between individuals and their information. With frameworks like SeCuDAs, citizens gain true agency, autonomy, privacy, and security over the data they generate, deciding how it is shared, licensed, or monetized.

At the same time, this shift creates new opportunities for organizations such as standards bodies, regulators, and accounting firms. They can develop new audit tools, valuation models, and compliance standards to support data as a legitimate asset class—similar to how accounting standards evolved for intangible assets like IP and goodwill.

💡 Case in Point: SeCuDAs & Innovorsa’s Thesis

Innovorsa’s investment thesis mirrors the NAC philosophy but for data:

“Unlocking the trapped value of data within businesses—and SeCuDAs (Self‑Custody Data Assets) are the key enabling mechanism.” (Innovorsa on SeCuDAs).

Like NACs for forests, SeCuDAs turn data into an investable, yield-generating asset class—one that is:

Programmable (can be embedded in rules and smart contracts)

Self-custodied (retained by the data subject or enterprise owner)

Standardized & Secure (interoperable across markets)This aligns perfectly with global regulatory momentum: as digital assets gain legal clarity, data can join carbon and biodiversity as the next frontier of market-recognized assets.

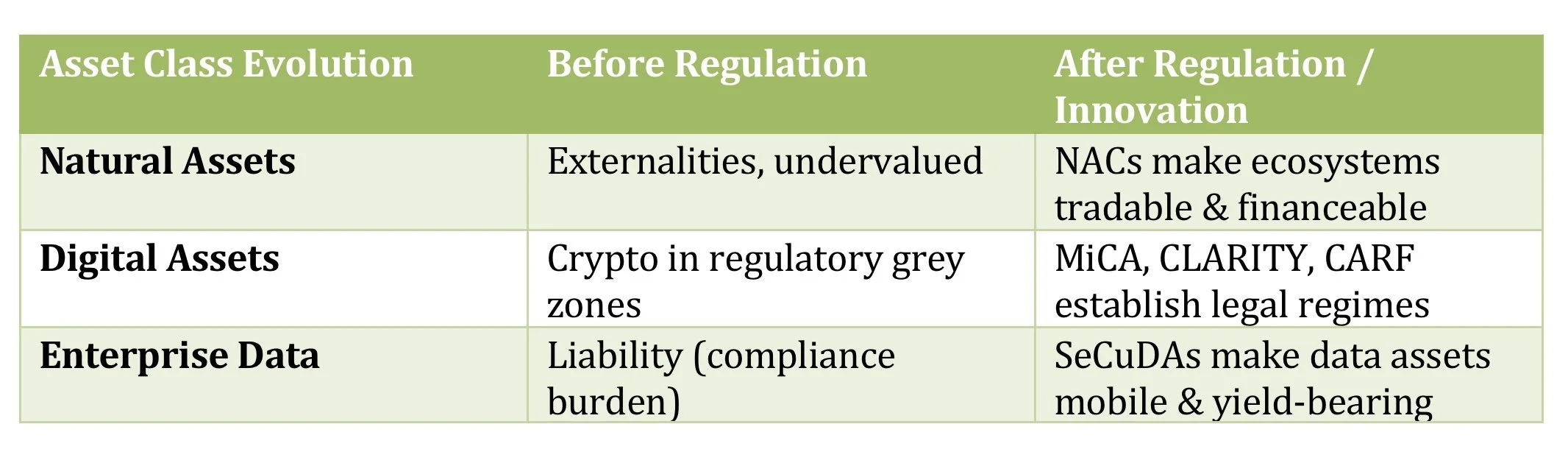

📌 Summary Table

🧠 Why It Matters to Businesses

Balance‑sheet transformation: Like natural capital, data becomes an ownable, auditable, financeable asset class.

Market access and liquidity: Compliance frameworks allow structured data markets, much like carbon markets.

Innovation alignment: Companies that prepare tokenized data via SeCuDAs will be positioned as early leaders in this data-as-asset era.

Citizen empowerment: Individuals gain control over their data, strengthening autonomy, privacy, and security in digital economies.

Institutional innovation: Standards bodies and accounting firms can pioneer valuation tools and compliance frameworks to formalize data as a recognized asset class.

👉 Bottom line: Just as NACs made nature financeable, digital asset bills are making data financeable. Together, they signal a wider market transformation where intangibles and commons are becoming investable frontiers—with both citizens and institutions playing vital roles.